Financial markets perform the essential economic function of channeling funds from households, firms and governments that have surplus funds by spending less than their income, to those that have a shortage of funds because they wish to spend more than their income. Finance can be either direct, or indirect.

In direct finance, borrowers borrow funds directly from lenders in financial markets, by selling them securities (also called financial instruments), which are claims on the borrower’s future income or assets. Securities are assets for the lender, but liabilities (IOUs) for the borrower.

Securities take the form of either bonds or stocks. Bonds are debt securities that promise to make periodic payments for a specified period of time. Stocks are securities that entitle the owner to a share of a company’s profits or assets.

In indirect finance this exchange of securities takes place through financial intermediaries, usually banks.

Financial markets allow funds to move from those who lack productive investment opportunities to those who have such opportunities, and thus contribute to an efficient allocation of capital that increases economic welfare.

Financial Intermediaries

Financial intermediaries stand between lenders-savers and borrowers-spenders and help transfer funds from one to the other. This is called indirect finance.

In fact, financial intermediation is the main route for moving funds from lenders to borrowers, and is mainly conducted by depository institutions (commercial banks, savings and loans associations, mutual savings banks and credit unions), by contractual savings institutions (life insurance companies, pension funds and government retirement funds), and by investment intermediaries (finance companies, mutual funds, hedge funds and investment banks).

To understand the role and significance of financial intermediation one must understand the roles of transaction costs, risk sharing and information costs in financial markets.

Transaction Costs

Financial intermediation implies lower transaction costs because of specialization, economies of scale and the provision of liquidity services.

In addition, because of the scale of their operations, financial intermediaries can reduce the risk of lending, by pooling different types of risk. Thus, they turn individually risky assets into safer composite assets, through diversification (“You should not put all your eggs in one basket”).

By holding a larger and safer portfolio of risky assets, financial intermediaries are thus able to offer savers a safer menu of assets at a lower cost than if savers tried to do the same on a smaller scale.

Asymmetric Information: Adverse Selection and Moral Hazard

Another reason for the importance of financial intermediation is asymmetric information. Borrowers usually have better information than lenders about the risk and return of the investment they are about to undertake, and in addition, lenders cannot usually monitor the behavior of borrowers after they have lent them the money.

Asymmetric information creates two types of problems. Adverse selection and moral hazard.

Adverse selection is the problem created by asymmetric information before the transaction takes place. Adverse selection occurs when the riskier borrowers, the more likely to produce an adverse outcome, are the ones more actively trying to secure a loan. Because of adverse selection, lenders may decide not to make any loans, although good credit risks exist.

Moral hazard is the problem created by asymmetric information after the transaction occurs. It is the risk (hazard) that the borrower might ex post engage in activities that are undesirable (immoral) from the view point of the lender, because they reduce the probability that the loan might be re-paid. Hence, again, borrowing and lending may break down because of this risk.

With financial intermediation, small savers can deposit their funds with the financial intermediary who, because of the specialization and the scale of their operations, have better means to address asymmetric information, by screening aspiring borrowers and monitoring the behavior of borrowers ex post. Thus, financial intermediaries can mitigate the problems of asymmetric information and expand the market.

Economies of Scope and Conflicts of Interest

Most financial intermediaries provide a range of financial services to their customers. Banks take in deposits, offer loans, provide liquidity services through checking accounts, insurance services and so on. Thus, financial intermediation also implies economies of scope.

Economies of scope create the potential for conflicts of interest, a type of moral hazard problem that arises when an agent has multiple objectives (interests) some of which conflict with each other. Conflicts of interest are more likely to occur when a financial institution provides multiple services.

The Risks of Financial Intermediation

Financial intermediation increases the efficiency of the financial system, but is not without risks.

For a start, the problem of asymmetric information remain. Intermediaries have better information about risks than their lenders and worse information than their borrowers. Hence, the need for government regulation to reduce the problems of asymmetric information.

In addition, financial markets are vulnerable to systemic risks. A negative systemic shock can destabilize them, especially as there is a discrepancy between the maturity structure of the liabilities and the assets of financial intermediaries. The liabilities of financial intermediaries are typically safe short term securities (e.g. checking accounts), while their assets are riskier and longer term (e.g. long term loans and bonds). If there is a shock that reduces the return of their assets and at the same time shakes the confidence of lenders-savers, leading them to withdraw their deposits, financial intermediaries may run into liquidity or solvency problems. Again, the possibility of such systemic risks creates the need for regulation.

In the absence of regulation, adverse shocks may lead to a destabilization of the financial system and a financial crisis.

Debt versus Equity Markets

A borrower can obtain funds in financial markets in two ways:

Through issuing a debt instrument, such as a bond or a mortgage. This is a contractual agreement by the borrower to pay the holder of the instrument fixed dollar amounts at regular intervals (interest and principal payments), until a specified date (the maturity date), when a final payment is made. The maturity of a debt instrument is the number of years (term) until the instruments expiration date. A debt instrument is short term if its maturity term is less than a year, and long term, if its maturity term is ten years or longer. Debt instruments with a maturity term between one and ten years are said to be intermediate term.

Through issuing equities, such as common stock, which are claims to share in the net income and the assets of a business firm. Equities often make periodic payments (dividends) to their holders and are considered long-term securities because they do not have a maturity date. Owing common stock means that you own a portion of the firm and gives you the right to vote on issues important to the firm and the election of its directors.

The main disadvantage of being an equity holder is that you are a residual claimant, i.e the corporation must satisfy debt holders before equity holders. As an equity holder you benefit from an increase in the firms profitability but also you lose from a decrease in the firms profitability. Bond holders receive fixed amounts. The bond market is larger than the equity market. At the 2nd quarter of 2022 the global fixed income (bond) market was worth over $122.6 trillion, versus $94 trillion for the value of equities.

Primary versus Secondary Markets

A primary market is a financial market in which new issues of a security, such as a bond or a stock, are sold to initial buyers by the corporation or government agency borrowing the funds.

A secondary market is a financial market in which securities that have been previously issued can be resold.

Primary markets are dominated by investment banks which underwrite a corporation’s or a government’s securities and then sell them in the secondary market.

Secondary markets are important because they make financial instruments more liquid, thus increasing their attractiveness to investors. They are also important for the determination of the price of securities and thus affect the pricing of securities in the primary market as well. Conditions in secondary markets are therefore the most relevant for corporations and governments issuing securities.

Exchanges and Over-the-Counter Markets

Secondary markets are organized in one of two ways:

Exchanges, where buyers and sellers of securities (or their agents or brokers) meet in one central location to conduct trades. The New York Stock Exchange (NYSE) and the Chicago Board of Trade for commodities are examples of such organized exchanges.

Over-the-Counter Markets (OTC) consist of dealers in different locations who stand ready to buy and sell securities “over the counter”. The OTC market relies on electronic communication systems, trades and prices are known to everybody, and is thus very competitive.

Many stocks are traded OTC but the majority of the large corporations have their shares traded at organized stock exchanges. The US government bond market, with a trading volume larger than NYSE is entirely OTC. There are about forty dealers who establish the market in US government securities, standing ready to buy or sell. Other types of securities such as negotiable securities of deposit, federal funds and foreign exchange are also traded in OTC markets.

Money and Capital Markets

Another distinguishing characteristic of financial markets is the maturity term of the securities traded.

The money market is a financial market in which only short term debt instruments are traded, i.e those with original maturity terms of less than one year.

The capital market is the market in which longer term debt instruments and equity instruments are traded.

Money market securities are usually more widely traded than longer term securities, making them more liquid. They also tend to have smaller fluctuations in prices, making them safer instruments. Such instruments are US Treasury Bills, negotiable certificates of deposit, commercial paper, repurchase agreements (repos) and Federal Funds.

Capital market instruments are corporate stocks, residential mortgages, corporate bonds, US government bonds, state and local government bonds, bank commercial loans, consumer loans and commercial and farm mortgages.

Money markets are used by banks and corporations to earn interest on surplus short term funds, while capital market instruments are held by insurance companies and pension funds which have long term liabilities.

Internationalization of Financial Markets

International borrowing and lending takes place through international financial markets. Exchange rates are determined in the foreign exchange market, which is an important component of international financial markets.

The internationalization of financial markets is the result of globalization, the deregulation of foreign financial markets and the existence of large pools of savings in Asia and elsewhere.

Foreign bonds, Eurobonds and Eurocurrencies are the main financial instruments exchanged in international financial markets. Foreign bonds are bonds sold in a foreign country, but denominated in its currency. Eurobonds are bonds denominated in a currency other than the one of the country in which they are sold. Eurocurrencies are foreign currencies deposited in banks outside their home country.

The foreign exchange market is by far the most important international financial market, but stock and bond markets have become internationalized as well.

The major agents operating in these markets are commercial banks, non-bank financial institutions, multinational corporations, central banks and governments.

International financial markets are actually a network of closely related markets in various countries, where securities denominated in various currencies and coming from different countries, such as stocks, bonds, derivatives, loans and bank deposits are created and exchanged.

We can distinguish between the international bond market, the international stock market and the international money market, a significant part of which is the international foreign exchange market. Transactions in these markets take place in global financial centers linked through advanced telecommunication systems.

International Financial Markets and the Financing of External Imbalances

External imbalances of a country, i.e differences in receipts from payments for international transactions, can be financed through a number of ways:

- Foreign Exchange Reserves (short term)

- International Bond Issues: Bond issues are the main method of financing for advanced economies. It used to be the main method of financing for less developed economies until 1914, and in the inter-war period. Bond issues by less developed economies have staged a comeback after 1990, with the liberalization of the financial systems of developing economies.

- International Bank Loans: Since the end of the 1970s, and until the end of the 1980s this was the main method of financing for less developed economies. In the beginning of the 1980s bank lending corresponded to the whole of the current account deficits of less developed economies. Since then, the importance of international bank lending has diminished, although it remains one of the most important methods of finance.

- Official Borrowing (IMF, World Bank, other governments): These loans may be concessionary, or at market interest rates. Before the 2008-09 crisis, official lending had been very low, used for very poor economies, such as those of sub-Saharan Africa. Official lending has made a comeback after the 2008-2009 crisis, and is mainly used by countries which have agreed an adjustment program with the IMF.

- Foreign Direct Investment: Financing the creation or development of subsidiaries of multinational enterprises. If a Japanese firm invests in its subsidiary in the US, then this is foreign direct investment, which also helps finance the US current account deficit.

- International Portfolio Investment: If a Japanese insurance fund were to buy shares of a US company, or US sovereign or corporate bonds, this is an international portfolio investment, and helps finance the deficit of the current account of the USA.

International bonds, international bank loans and official lending constitute debt, whereas foreign direct investment and international portfolio investment in shares does not constitute debt.

The difference between the two methods of financing is that in debt contracts, the borrower agrees to repay in specific installments (interest and amortization) to the lender, irrespective of conditions, while in the case of equity investment, the investor shares in the profits of firms only if the firms make profits.

Differences between Advanced and Less Developed Economies

The problem with less developed economies is that a large part of the financing of their current account deficits is through external debt, and in particular debt denominated in foreign currencies. International investors tend to refrain from assuming the currency risk associated with a peripheral currency, even if they assume the country risk.

On the other hand, the major advanced economies, whose currencies are widely traded internationally, almost always borrow in their own currency. Thus, the US borrows in US dollars, the Euro Zone economies in euro’s, Japan in Japanese yen, Britain in sterling. Even Switzerland, due to the international acceptance of the Swiss franc, borrows in its own currency.

A country that can borrow in its own currency has significant advantages over countries which cannot do this. It can continue servicing its loans, even if it has to resort to issuing money in order to pay its creditors. So it does not run the risk of default. This option is not available to developing economies which borrow in foreign currency.

The inability of less developed economies to borrow in their own currency, is often called the original sin. On the other hand, the ability of the US to borrow in dollars, and in this way to reduce the real value of its international obligations, is often referred to as the exorbitant privilege of the US.

It is also worth noting that, as shown by the recent crisis in the economies of periphery in the euro area, participation in a single currency area like the euro area does not ultimately absolve a less developed economy from the original sin.

The governments of a small open economies participating in the euro area cannot rely on the European Central Bank (ECB) to lend them euros to service their euro denominated debts, or the debts of their banks. This is because of the ECB’s political independence and the prohibition of monetary financing of budget deficits by the ECB. In essence, the statutes of the ECB do not allow it to function effectively as a lender of last resort to euro area governments, in contrast to the central banks in the US, Britain or Japan who do in fact act as lenders of last resort to their respective governments.

The International Foreign Exchange Market

The international foreign exchange (ForEx) market is an international money market where short term securities, mainly deposits, denominated in different currencies are exchanged.

The ForEx market is essentially an international network of traders in currencies.

The vehicle currency through which most transactions take place is the US dollar

Exchange rates are determined in the foreign exchange markets through: 1. Spot Transactions, 2. Swap transactions, and, 3. Forward Transactions.

In spot transactions the transaction closes immediately (in fact within two days). These transactions determine spot exchange rates.

In swap transactions, the currency is simultaneously bought (sold) today and resold (re-bought) at a future date. The value of both the spot and the forward exchange rate is determined today, at the moment the swap transaction is concluded.

In forward transactions there are current agreements for future purchase or sale of a currency. The price, quantity and the date of the transaction are determined today.

The swap rate is the difference between the repurchase rate (repo) and the spot exchange rate. The spot exchange rate and the swap rate jointly determine the forward exchange rate.

Swap and forward transactions take place for 1 and 2 weeks, and for 1, 3, 6 and 12 months.

We say that a currency trades at a premium when the forward exchange rate is higher than the spot rate. Otherwise it trades at a discount.

The vast volume of transactions in the foreign exchange market are spot transactions between dealers. Swap transactions constitute about 1/3 of the total volume. Forward transactions constitute a very small percentage of the total volume.

The financial instruments used in the foreign exchange market are Euro-deposits and Euro-currencies, i.e deposits in currencies outside the country in which the currency is issued. A deposit in yen in New York or London is a Euro-deposit, as is deposit in dollars or euros in Tokyo, or London or Hong Kong.

The different currencies are bought and sold through dealers located in major international banks and financial institutions.

Dealers hold currency reserves, and their goal is to make profits by buying cheaply and selling dearly.

The foreign exchange market is characterized by high liquidity and the trading volume is huge.

The volume of foreign exchange transactions is much greater than the volume of transactions necessary for financing international trade.

The US Dollar as a Vehicle Currency

The US dollar is considered as a vehicle currency for transactions in the foreign exchange market.

For example, to convert sterling into yen usually requires two transactions. One to convert sterling into dollars, and one to convert dollars into yen.

Because of the depth (high trading volume) in the dollar market, the cost of this triangular transaction is usually less than the direct exchange of sterling for yen.

This applies even more forcefully to lesser currencies, especially the currencies of less developed countries.

Arbitrage and Exchange Rates

In the foreign exchange market, because of arbitrage, there are no potential profits from triangular transactions in different currencies.

For example, if S1 is the sterling dollar exchange rate, S2 the euro dollar exchange rate, and S3 the sterling euro exchange rate, and transactions have no cost, in equilibrium it can only be the case that,

S1=S3 x S2

Eurocurrencies and Eurobonds

A eurocurrency deposit, or a eurodeposit, is a deposit in foreign currency outside the country issuing the currency.

A deposit in US dollars in a London or Hong Kong or a Tokyo bank is a eurodollar deposit, while a deposit in yen at a bank in New York, London or Hong Kong is a euroyen deposit. Most eurodeposits are fixed interest rate deposits, with terms reflecting those available for swap and forward currency transactions. Most foreign exchange transactions take place through funds deposited in eurocurrencies.

The name eurocurrency, or eurodollar derives from the dollar deposits in European banks following the transfer of US dollar funds from the United States to Europe, through the Marshall plan after the end of World War II. It has nothing to do with the single European currency the euro.

A more recent development is related to so called eurobonds, that is bonds issued in a foreign currency outside the country of origin of this currency. Thus, a bond issued in dollars in London is a eurobond, as is a bond issued in yen in New York.

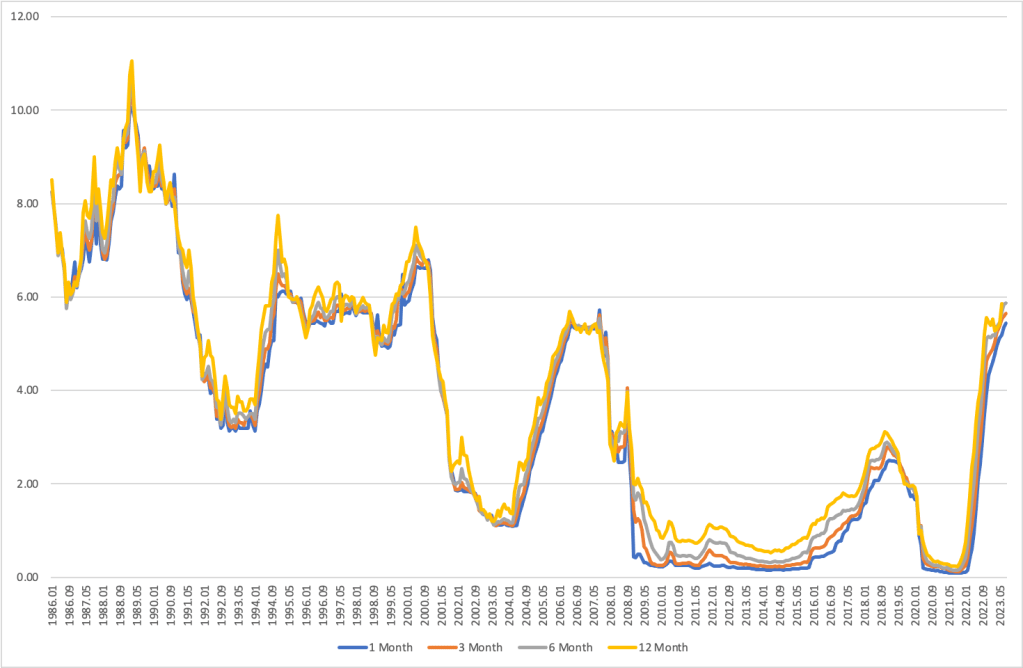

The LIBOR and the EURIBOR

The LIBOR (London Interbank Offered Rate) is the interest rate at which banks are willing to lend dollars, euros or pounds to the most reliable banks and non-bank enterprises that participate in the London interbank market. It is an interest rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. Loans to less reliable banks and enterprises have a higher rate than LIBOR (premium). Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates such as SOFR and SARON.

The EURIBOR (Euro Interbank Offer Rate) is the rate at which banks are willing to lend euros to the most reliable banks and non-bank enterprises, participating in the euro area interbank market. It is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks borrow unsecured funds from counterparties in the euro wholesale money market (or interbank market). Loans to less reliable banks and enterprises have a higher interest rate than EURIBOR (premium). Euribors are used as a reference rate for euro-denominated forward rate agreements, short-term interest rate futures contracts and interest rate swaps, in very much the same way as LIBORs are commonly used for Sterling and US dollar-denominated instruments. They thus provide the basis for some of the world’s most liquid and active interest rate markets. Euribor should be distinguished from the less commonly used “Euro LIBOR” rates set in London by 16 major banks.

The LIBOR and the EURIBOR vary depending on the loan term (from one week to 12 months), and generally depend on financial conditions in the country issuing the currency. Thus, the dollar LIBOR is close to short term interest rates in New York, whereas the euro LIBOR or the EURIBOR is close to short term interest rates in Euro Area financial markets (Frankfurt, Paris, Milan etc).

Comparing Rates of Return in Different Currencies

Suppose you are a bank or a money market fund and have 1 million $ to invest for a year.

If you invest in a dollar deposit, at the end of the year you will get 1+i$

If you invest in a euro deposit, you must first convert your $ million into euros. Thus you will invest S times one million, where S is the spot euro/dollar exchange rate. At the end of the year, you will earn (1+i€)S in euros.

At the same time as you make the spot transaction buying the equivalent of $1m in euros, you can make a forward transaction, selling (1+i€)S million euros in the forward market, and buying back dollars at the forward exchange rate F.

Thus, at the end of the year you will use your (1+i€)S euros to fulfill your forward contract, and you will be left with (1+i€)(S/F) dollars.

Thus, the rate of return in dollars of your euro deposit is certain and equal to (1+i€)(S/F).

Equilibrium in the Swap Foreign Exchange Market: Covered Interest Parity

Forex traders in the swap market, will be buying and selling the two currencies until the rate of return of a dollar deposit is equal to the rate of return of a euro deposit, adjusted by the swap rate of a euro deposit when the euros are converted back to dollars.

This means that they will be buying and selling currencies, changing the spot and the forward exchange rate, until,

(1+i$)= (1+i€)(S/F)

This equilibrium condition, is called covered interest parity.

If this condition is violated, expected profits can be made by borrowing in one currency and lending in the other. These expected profits will lead to arbitrage, i.e equilibrating trades, until the condition is satisfied and no incentives for further equilibrating trades exist. Given the speed of transactions in forex markets, the condition will be satisfied almost continuously.

What Determines the Future Exchange Rate: Expected Future Spot Rates and Uncovered Interest Parity

The profit from a swap or forward transaction in the foreign exchange market is the difference of the forward rate from the spot rate, at the end of the term of the transaction. Consequently, at the time of agreement to the forward transaction, with the assumption of risk neutrality, it should apply that,

F=Se

where Se is the expected future spot rate at the end of the term of the forward transaction.

Hence, under the assumption that traders are risk neutral, the forward rate is equal to the expected future spot rate. Substituting in the covered interest parity condition we get that,

(1+i$)= (1+i€)(S/Se)

This equilibrium condition, is called uncovered interest parity.

In fact, a risk neutral forex trader may not use the swap market at all and concentrate on the spot market.

The Determinants of Spot Exchange Rates

Solving the covered interest parity condition and assuming that future rates as equal to expected future spot rates, we get that,

S=Se((1+i$)/(1+i€))

Three factors determine the spot euro/dollar exchange rate

First, the dollar nominal interest rate. Other things equal, a rise in the dollar nominal interest rate causes the dollar to appreciate against the euro, as S goes up, and vice versa.

Second, the euro (foreign) nominal interest rate. Other things equal, a rise in the euro nominal interest rate causes the dollar to depreciate, as S goes down, and vice versa.

Third, the expected future spot rate. An expected future appreciation of the dollar causes the dollar to appreciate immediately. An expected future depreciation of the dollar causes the dollar to depreciate immediately.